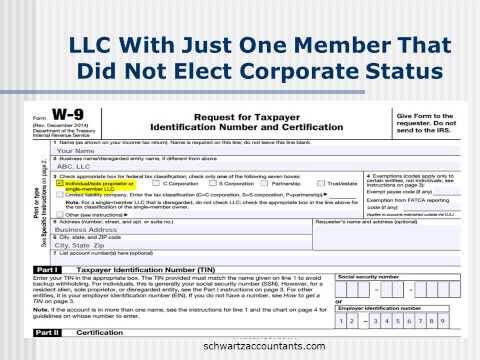

Hi guys! Inverse warts here to discuss how businesses set up as LLCs should complete a W-9 form. Completing a W-9 form for your LLC can be a little tricky. That's because LLCs were set up to be very flexible entities. For starters, LLCs can elect to be treated as a corporation by checking a on Form 8832. Alternatively, an LLC can elect to be treated as an S corporation by simply filing Form 2553 with the IRS. For LLCs electing to be treated as a corporation, put the name of the LLC on line one - the business name if different goes on line two. Check the next to where it says "Limited Liability Company" and then write in a "C" for AC corporation or an "S" for an S corporation at the end of the row. Also, enter the address as requested in the Employer Identification Number (EIN) in the middle of the form. For LLCs that have not elected to be treated as a corporation and have more than one owner, the LLC will be treated as a partnership. Put the name of the LLC on line one - the business name if different goes on line two. Check the next to "Limited Liability Company" and write in the letter "P" at the end of that row. Enter the address as requested in the EIN in the middle of the form. Now, for LLCs that have not elected to be treated as a corporation and have only one owner, they are treated as disregarded entities for tax purposes and are essentially sole proprietors. Put the owner's name on line one - the name of the LLC and/or the business name if different goes on line two. Enter the address as requested and then put either your social security number or...

Award-winning PDF software

Video instructions and help with filling out and completing Fill Form 8865 Taxpayer