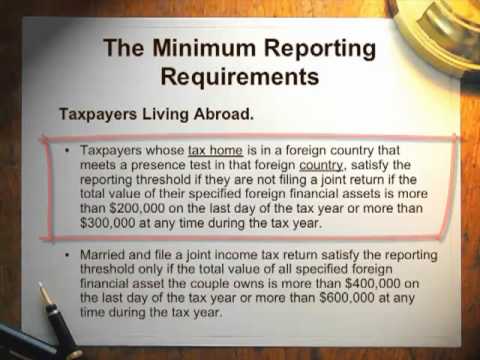

Richard S. Layman has over 35 years of practicing tax law in the United States. Mister Layman has had extensive experience with all areas of the Internal Revenue Code that apply to American taxpayers and non-resident aliens and foreign corporations investing or conducting business in the United States, as well as US citizens and domestic corporations investing abroad. Richard has a national reputation for handling the toughest tax cases, structuring the most sophisticated income tax and estate tax plans, and defending clients before the Internal Revenue Service. Richard Layman began his career in tax law with a law degree from Georgetown University, a master's degree in tax law from New York University, and two years of clerking for the Honorable William M. Fay, a judge on the United States Tax Court in Washington, DC. He spent several years as the senior attorney of the interpretive division of the chief counsel's office at the Internal Revenue Service, the IRS' internal law firm. Today, Richard works with other lawyers, accountants, business leaders, and individuals who are struggling to find their way through the complexities of United States tax law. Today, we are going to talk about some recent developments in United States tax law. One significant change is the Foreign Account Compliance Act, which requires US taxpayers to disclose all kinds of foreign assets, beyond just foreign bank deposits. We will also discuss a new amnesty program from the IRS, allowing individuals who have not disclosed foreign assets and owe taxes to come forward and avoid criminal penalties. Additionally, starting in 2013, there will be a requirement for all foreign financial institutions to report American accounts and income to the United States. Certain non-financial foreign companies with substantial US owners will also have reporting requirements. This new reporting system is reciprocal, meaning countries will...

Award-winning PDF software

Video instructions and help with filling out and completing Form 8865 Amnesty