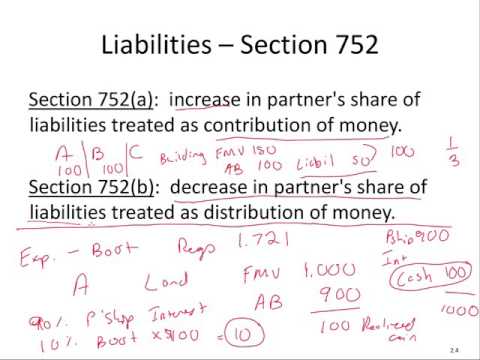

Hello, in this video, we will consider the tax consequences of contributions to the partnership with respect to the partner and the actual partnership itself. Now, it's important to understand that this topic refers to the contributions of partnerships, but we can also deal with the formation of a partnership. The general rule under Section 721 is that there is no recognition of gain or loss on the contribution of property by the partner to the partnership. This applies to both the partner and the partnership. Whether it's formation or a partner actually contributing to a partnership, it involves property being transferred in exchange for a partnership interest. However, this rule does not cover services. It's important to note that to receive non-recognition treatment, similar to the treatment for the transfer of property to a corporation, the partner must receive 80 percent or more ownership interest. But in the case of partnerships, there is no control requirement. The partner simply needs to be receiving a partnership interest in exchange for property. There's a special rule that applies to investment type companies, similar to Section 351. The key distinction is that there is no control requirement. This rule still applies, regardless of the ownership percentage, whether it's less than 1% or 100%. Under Section 722, basis rules apply to the partner. This refers to the partner's basis in the partnership interest, also known as the outside basis. If there is any gain recognized, it is added to the basis. We also need to consider the shifting of liabilities and the tacking of the holding period, which only applies to capital assets and assets under 1231. Section 723 applies to the partnership, and it carries over the adjusted basis from the contributing partner. Again, if there is any gain recognized, it is...

Award-winning PDF software

Video instructions and help with filling out and completing Form 8865 Partnerships