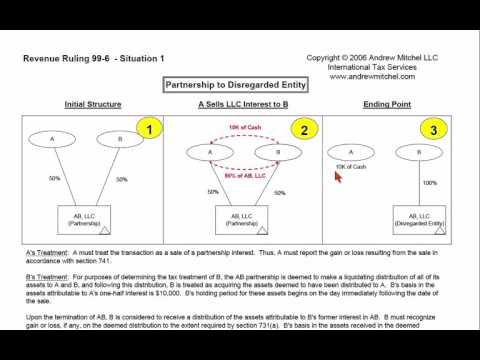

In Revenue Ruling 99-6, situation one, partner A and partner B each owned 50% of an LLC. The LLC was taxed as a partnership for US tax purposes. Partner A sold its 50% interest in the LLC to Partner B for $10,000 in cash. After the sale, Partner A held the $10,000 in cash, while Partner B owned 100% of the LLC. Consequently, the LLC converted from being a partnership to being a disregarded entity. The ruling stated that the treatment of the transaction to Partner A was different from the treatment of the transaction to Partner B. Partner A was treated as if they had sold a partnership interest. On the other hand, Partner B was treated as if the partnership was first liquidated, distributing its assets to both Partner A and Partner B, and then acquiring the assets that were distributed to Partner A for the cash amount of $10,000. As a result, Partner B generally had a carryover basis and holding period for the portion of the assets deemed distributed to them, while Partner A had a cost basis for half of each of the assets that it acquired from Partner B.

Award-winning PDF software

Video instructions and help with filling out and completing Form 8865 Sections