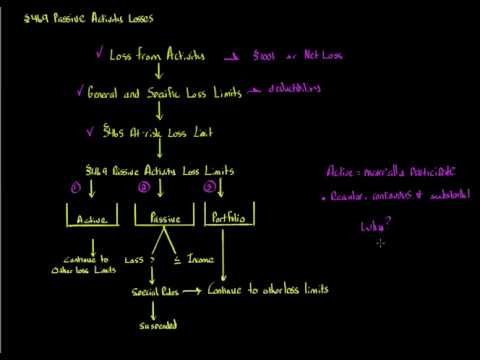

In this video, we'll consider section 469 passive activity losses. This is another really interesting topic because, again, you get to see the interplay of the various tax rules and how they all fit into the big puzzle. Now, before we actually get into the passive activity loss limitation rules, we first have to have a loss from an activity. In a previous discussion, I mentioned how a loss is very broad. It's not just the section 1001 sale or other disposition, which is what we normally think of. It can also be a net loss from a business type activity or investment type activity. For example, if you own a sole proprietorship and you receive ten thousand dollars of income for the year but you have $15,000 in allowable tax deductions that are related to the activity, that's gonna be a $5,000 net loss. So, that's what we were talking about, a loss from activity. Now, going down the line with respect to the various limitations on losses, we next have to consider the general and specific loss limitations. So, the general loss limitations are the big three. And before I go through the general and specific loss limitations, just a brief overview. We're talking about deductibility of losses, can we actually deduct the loss on the tax return. So, the general loss provisions deal with section 165. And in section 165, there are three types of activities with respect to losses. There's business, investment, and personal activities. Business and investment losses are generally allowed to be deducted, but personal losses are not. That's the general rule. Specific loss limits deal with related party transactions, wash sales, and others throughout the tax law. But those are some of the bigger ones. So, once we have a loss and once we go...

Award-winning PDF software

Video instructions and help with filling out and completing What Form 8865 Losses