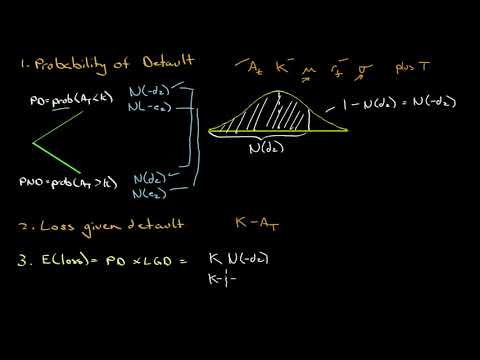

Well, let's begin our seminar for reading 38 for credit analysis models, and we're gonna go through the structural model and the reduced form model. But before we do that, let's sort of get a high-level view of what it is that we're looking for. And through both of these models, we want to keep our eye on these four measures of credit risk - the probability of default, the loss given default, the expected loss, and finally the present value of the expected loss. I'm gonna show you that number one, two, and three, if we were gonna just stop right here. If that's all we had to measure was one, two, and three. I'm gonna show you that that is nothing more than level one probability stuff. Going from three to four gets a little bit tricky. But I'm also gonna show you how it's really the same thing as doing number three twice, doing the expected loss but calculating it in two different ways. And only one of them will take the present value of. So it sounds kind of abstract, but let's start with just a really basic simple thing. And if you get what I'm about to show you, everything that we do is just this with a little bit more complexity to it. So let's say we have a situation where we have a thousand dollar bond due in one period that we have to pay. We're either gonna pay the thousand dollar bond in one period, which means we are not going to default. This is the probability of default up here. This is the probability of no default, so default prime. Let's say we say a probability of 90%, as we go through the structural model in the reduced form model we'll...

Award-winning PDF software

Video instructions and help with filling out and completing What Form 8865 Reduction