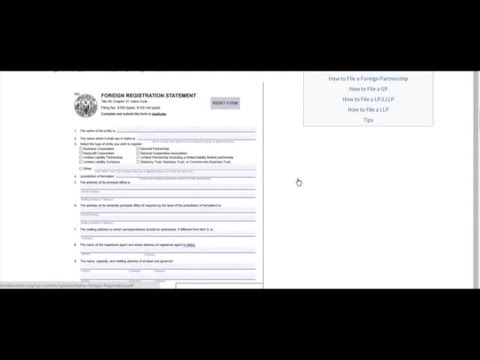

Hi there! Today, we're going to talk about how to start a partnership in the state of Idaho. There are different types of partnerships, such as LP (limited partnership), LLP (limited liability partnership), and general partnership. To comply with the Idaho state statutes, all partnerships need to be filed under Title 53 Chapter 26, Title 32 Chapter 23, and Title 32 Chapter 24. One key thing to note is that there is no online option for partnership registration. You will need to download a PDF file, fill it out, and pay a $100 filing fee by check. All filings should be duplicated. When you download the necessary filing form, you'll find two identical forms that need to be filled out. If you're a foreign partnership, you'll also need to provide a certificate of existence from your original state or country of formation. This is required when filing a foreign registration statement. Attach the necessary documents and a check and send them to the address provided. Before filing, it's important to check if the name you want to use for your partnership is already registered by another business entity in Idaho. Use the business entity search function on the secretary of state website to ensure your name is unique and distinguishable from others. You may also want to consider reserving the name for a fee of $20 to prevent it from being taken. For foreign partnerships, regardless of whether you are a GP, LP, LLP, or LLP, you will need to file a foreign registration statement. The state statutes regarding LPS and LLPs can be found on the provided link. Alternatively, you can download the foreign registration statement and enter the required information, including the partnership name to be used in Idaho, entity type, registered agent information, and address of principal office. General partnerships don't need...

Award-winning PDF software

Video instructions and help with filling out and completing When Form 8865 Acquisition