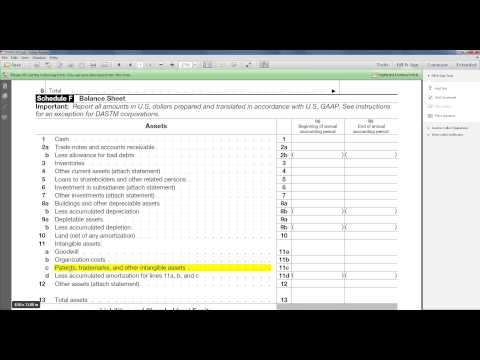

Oh, Excel in in the place where we could give the clients the biggest value. Biggest value should mean bigger fees, so anyway let's just get into one of the somewhat new ten years old, but for international tax law, that's new. Things move really slow in international tax law and it has to do with foreign currencies. Currencies cause always go up and down and this is the IRS bulletin on a new rule, a new regulation dealing with dollar approximate separate transaction method of accounting. And I just want to kind of go over the definition for you quickly. You can see the ruling here, you go of course obviously played this video, but I want to go over the definition because it kind of throws people off when they see this term here. And it provides the translation rates that must be used when translating into dollars certain items an amount transferred by a qualified business unit to his home office or parent corporation for purposes of computing dollar approximate separate transaction method the DEA STM gain of loss. And this is has to do primarily with a qualified business union. A qualified business unit is a active business in a foreign country run by a foreign corporation. Sometimes, a foreign corporation may have a business in a nation other than where it is incorporated and there's been concern about the proper accounting for currency gains and losses. And as we see today's road, the currency is volatile, it always seems to be volatile, and so part of our job is to get the Italian to be consistent and usually consist approach. So, the regulations actually have some rules and when you when we get to the county insider that's financial statement, you're gonna see that we...

Award-winning PDF software

Video instructions and help with filling out and completing When Form 8865 Category