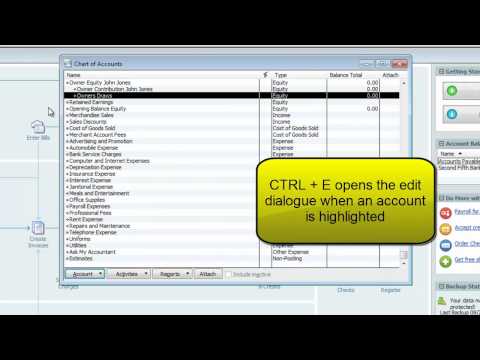

It's important to accurately keep track of both the funds invested in a business and the funds drawn from a business. - Sometimes, QuickBooks users will mistakenly record owner injections as income or owner draws as expenses. - The structure of equity accounts can differ greatly depending on how the business is organized. - Equity accounts will have different names depending on if it's a sole proprietorship, a partnership, an LLC, an S corporation, or a C corporation. - Even though these accounts have different names, their purpose is similar: to keep track of ownership interest in the business. - QuickBooks will create different account structures for equity depending on the type of business selected. - In this tutorial, we'll focus on a sole proprietorship. - Opening balance equity is a holding account used to offset entries when a new file is being set up. - The balance of this account should be zero once the new file is established. - Owner equity is the retained earnings account. - The net income at the end of the year will be rolled into this account by QuickBooks. - It is important not to post to this account. - Instead, we'll create an additional equity account for owner contributions. - The owner draw account is used to record draws on capital by the owner or owners. - There are default equity accounts that QuickBooks creates for other types of business entities. - There should always be an account for each owner for both contributions and draws from the business. - In addition to the retained earnings and opening balance equity accounts, there should be accounts for contributions and draws. - This example uses a brand new company file called "Play It Twice Sporting Goods." - There are currently no transactions entered yet....

Award-winning PDF software

Video instructions and help with filling out and completing When Form 8865 Contribution