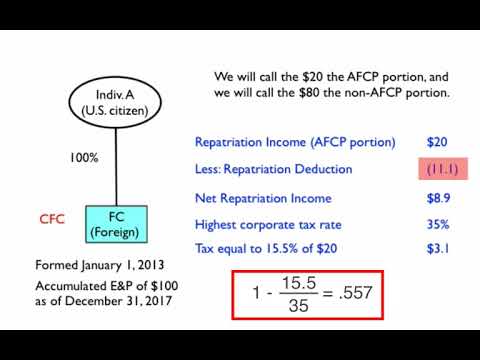

Music in this video, we're going to discuss the treatment of deferred foreign income upon the transition to the participation exemption system of taxation under the Tax Cuts and Jobs Act of 2017. In this example, Individual A is a US citizen who owns a hundred percent of FC, a foreign corporation. FC is a Controlled Foreign Corporation (CFC) that was formed on January 1st, 2013. FC has accumulated earnings and profits of a hundred dollars as of December 31st, 2017. FC is a specified foreign corporation because it is a CFC. FC has posted $1986 earnings and profits of $100. All of the hundred dollars of post-1986 earnings and profits is accumulated post-1986 deferred foreign income (DFI). Since FC's DFI is greater than FC, it is a Deferred Foreign Income Corporation (DFIC) for the 2017 year. FC's Subpart F income will be increased by $100, the amount of FC's DFI. We will call this support F income repatriation income. Individual A will be able to claim a deduction on his 2017 tax return the same year that he has the repatriation income. The amount of the deduction will depend on the amount of cash and other liquid assets held by FC at the end of 2017. The amount of FC's aggregate foreign cash position (AFCP) is $20. If we assume that FC had cash and other liquid assets of $20, then $20 of repatriation income will be offset by a repatriation deduction based on a 15.5% rate and $80 of repatriation income will be offset by a repatriation deduction based on an 8% rate. We will call the $20 the AFCP portion and the $80 the non-AFCP portion. Starting with the AFCP portion, the repatriation income is $20 less the repatriation deduction that we don't yet know. We have to...

Award-winning PDF software

Video instructions and help with filling out and completing When Form 8865 Contributions