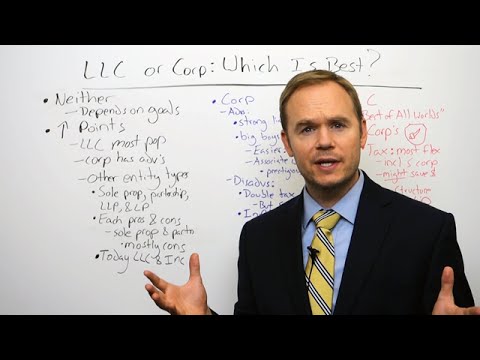

Hello and welcome to an edition of Genesis Law Firm teaches. Today's topic is whether to form an LLC or a corporation, which is better. This is a very frequently asked question. Should I form an LLC, a limited liability company, or should I form a corporation for my new business? The answer is that neither is necessarily the better option. It depends upon you and what you want to accomplish with your business. In this video, we're going to go through the high points of this discussion, which is better, an LLC or a corporation. LLC's are the most popular and any choice available, including when compared to corporations. But corporations do have their advantages. By the way, there are many other entity types out there. You could be a sole proprietor, a partner, you could be a limited liability partnership, a limited partnership, and all of these entity types have their pros and cons. By the way, if you form a sole proprietorship or a partnership, there are probably more cons than pros. Usually, you won't want to choose those two options. You'll want one of these other options that I mentioned, a limited liability entity like a corporation or LLC. In today's video, we're going to focus exclusively on LLCs and corporations because they are the most popular two entity types. Let's first look at corporations and their advantages. Corporations have a very strong liability shield for their owners. In fact, this is the reason why there are so many corporations out there. When corporations first came into existence, it was the only way that you could create an entity shield of this type. So if you've really wanted to protect the individuals' assets and only expose whatever might have been invested in the business, then you would have...

Award-winning PDF software

Video instructions and help with filling out and completing When Form 8865 Entity