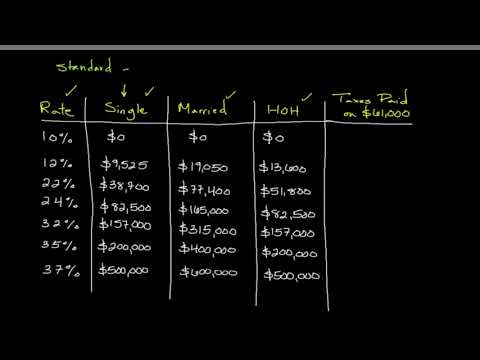

Hey, in this quick video, we're going to be talking about the US tax system. More specifically, we'll discuss how to calculate your taxable income if you live in the United States. You should know that we have a progressive tax system, which means that the more money you make, the more you pay in taxes. However, it works a little bit differently than most people think. This is the US federal income tax bracket for 2018, and it shows how much you will be taxed based on your income. For example, if you are single, the first $9,525 of your income is taxed at 10%. Any income over that amount will be taxed at a higher rate. For incomes between $200,000 and $500,000, the tax rate is 37%. The tax bracket is based on your filing status, which can vary from single to married to a head of household. Your filing status determines how much you pay in taxes. For example, if you are single, your tax rate will be different compared to if you are married. In this video, we will calculate the taxes someone would pay on $61,000, which is the median household income in the United States. We will assume the person is single and use the tax rates for single individuals. It's important to calculate your taxable income correctly for several reasons, including knowing how much to withhold from your paychecks. If you under withhold, you will have to pay more taxes the following year. On the other hand, if you over report your income, you may get a larger tax refund, but you have essentially given the government an interest-free loan. One important thing to note is the standard deduction. The standard deduction is $12,000 for single individuals. This means that $12,000 of your income is exempt from...

Award-winning PDF software

Video instructions and help with filling out and completing When Form 8865 Liabilities