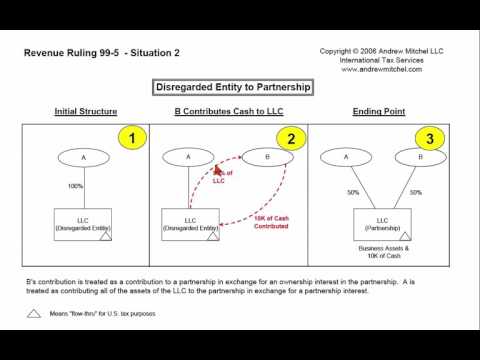

P>Revenue Ruling 99-5 dealt with the situation of converting a disregarded entity to a partnership through a contribution of assets into the LLC. In this ruling, individual A owned 100% of an LLC, which was treated as a disregarded entity for US tax purposes. Individual B contributed $10,000 of cash into the LLC in exchange for a 50% interest in the LLC. As a result of this change in ownership, the LLC was classified as a partnership for US tax purposes. The ruling held that both A and B were treated as contributing assets into the newly formed partnership. A was treated as contributing the assets of the LLC to the partnership, while B was treated as contributing the $10,000 of cash.

Award-winning PDF software

Video instructions and help with filling out and completing Where Form 8865 Contribution