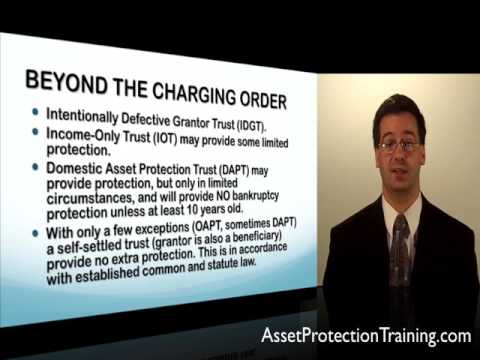

Hi, my name is Ryan. In other words, how can we get another layer of protection or even more protection than you get with the charging order protected entity, such as an LLC or partnership? Before you watch this video, I highly recommend you watch the video on LLC basics and what charging order protection is, or what the charging order is. So, to give a quick recap, the charging order is a legal protection that prevents creditors from seizing assets or gaining control of an LLC or partnership if you have an ownership percentage in the company. However, they can get a charging order that entitles them to distributions from the company if and when the manager decides to make those distributions. There are actually three types of trust that can provide even stronger protection. If you put your LLC interest in these trusts, creditors are out of luck. They cannot get a charging order. The three types of trust that provide this protection are the Defective Beneficiary Tax Trust (DBET), which is also known as the Defective Beneficiary Trust or the Beneficiary Tax Irrevocable Trust; the Special Power of Appointment Trust (SPA Trust); and the Offshore Trust. If you want to know if a trust will provide protection for your LLC or partnership, here's a key indicator: if it's a self-settled trust, it won't give you any protection, except in a few limited circumstances. A self-settled trust is where you are the grantor and the beneficiary, and you continue to benefit from the trust's assets. In most states, this type of trust does not provide asset protection. The three types of trust I mentioned earlier, the DBET, SPA Trust, and Offshore Trust, are not self-settled trusts, but they still allow you to benefit from the trust's assets. There are some other...

Award-winning PDF software

Video instructions and help with filling out and completing Why Form 8865 Apparel