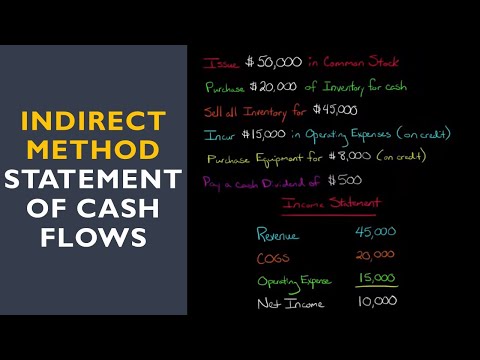

In this video, we're going to talk about how to prepare a statement of cash flows using the indirect method. A statement of cash flows is laid out as follows: cash flows from operations, cash flow from investing activities, and cash flow from financing. These three things are netted together to determine the change in cash over the period. If you need more details, there are videos on each of these topics available for you to check out. Now let's jump right into an example. Let's say we have the following activities for our startup company. We issue $50,000 in common stock to finance the company. Then, we buy $20,000 of inventory for cash and sell all the inventory for $45,000, receiving $35,000 in cash and $10,000 on credit. We also incur $15,000 in operating expenses on credit. Additionally, we purchase equipment for $8,000 on credit. Finally, we pay a cash dividend of $500 to equity holders during the year. To make it easier, we need an income statement and comparative balance sheets. We have a net income of $10,000 from the income statement and the balance sheets provide us with the necessary numbers to prepare our statement of cash flows. First, we start with the net income of $10,000. Then, we make adjustments to account for non-cash items. For example, we had an increase in accounts receivable of $10,000, meaning that $10,000 of sales revenue is not yet received in cash. This is a use of cash, so we put -10,000 in the cash flow from operations section. On the other hand, we had an increase in accounts payable of $23,000, which represents credit received for expenses. This is a positive number on the statement of cash flows, so we put 23,000 in the cash flow from operations section. Then, we...

Award-winning PDF software

Video instructions and help with filling out and completing Will Form 8865 Indirect